The 2025 budget bill made substantive changes to the clean energy credits available. Changes are summarized below. These changes exist in tandem with existing guidelines for each credit or deduction, which can be referenced here.

UPDATE: To qualify a business must begin construction before June 30, 2026.

Heating/cooling, lighting, and other efficiency projects associated with both new construction and facility retrofits can qualify for the Energy Efficient Commercial Building Deduction (179D).

For property placed in service in 2023 and after the deduction equals the lesser of:

The tax deduction applies to both new construction and retrofits. This deduction is permanent with no expiration.

The deduction amount is based on modeled energy savings; there are specific requirements associated with the energy modeling.

Additional Notes

For-profit businesses can take this deduction as often as every three years (assuming qualfied upgrades).

More Information

UPDATE: The tax credit for electric vehicle purchases by commercial entities now expires on September 30, 2025.

The IRA includes separate provisions for clean fuel tax credits for consumers and businesses. Although the consumer credits include specifications around vehicle components, businesses are not subject to this provision. That means businesses can claim the credit on a wider array of models than consumers can.

For qualified commercial clean vehicles, the credit equals the lesser of:

The maximum credit is $7,500 for qualified vehicles with gross vehicle weight ratings (GVWRs) of under 14,000 pounds and $40,000 for all other vehicles. The credit applies to road vehicles as well as mobile machinery, as defined in § 4053(8) of the Code. There is no limit on the number of credits your business can claim and elective pay is available for tax-exempt entities.

See also FAQs for the Commercial Clean Vehicle Credit

Vehicle Charging

UPDATE: A qualifying charging station must now be placed in service by June 30, 2026.

Businesses that install EV chargers and station equipment at their eligible property can qualify for a tax credit of up to 6% of the cost of charging equipment (or 30% if prevailing wage and apprenticeship requirements are met), up to a maximum credit of $100,000 per unit. Projects completed before December 31, 2022 are subject to the prior $30,000 cap.

Qualifying for Vehicle Charging Credits

To qualify, the charging equipment must be placed in a low-income community or a non-urban area. The US Treasury issued guidance details which areas are eligible; use this Department of Energy map to determine your individual eligibility.

Review the IRS guidelines for more specifics.

UPDATE: Geothermal heat pump credits (Section 48) are unchanged. Other credits remain available systems. There are, though, new Foreign Entity of Concern (FEOC) restrictions unless projects commence construction by December 31, 2025.

With the Investment Tax Credit entities can receive a 30% credit for geothermal, biogas, and other renewables energy installations. If the project is less than 1MW(ac) in size:

Geothermal heat pump, geothermal or biogas projects over 1 MW(ac) qualify for a 6% tax credit unless the project meets prevailing wage and apprenticeship requirements.

In situations where a facility is adding both solar and geothermal, the two systems might be considered parts of one whole (in which case the combined system must be under 1 MW(ac) or meet the prevailing wage requirements to receive the 30% credit) or be considered two separate clean energy projects (in which case the 1 MW(ac) maximum applies to each project). The consideration will depend on how the project is scoped and contracted.

Refer to IRS guidance for more information for more details.

Learn more about how to stack your your credits and deductions.

UPDATE: To qualify for wind or solar credits, systems must be placed in service by December 31, 2027 unless construction began by July 4, 2026 (in which case entities have four years to complete construction). Energy storage co-located with wind or solar can still claim the full credit through 2032. There are new Foreign Entity of Concern (FEOC) restrictions unless projects commence construction by December 31, 2025.

Hundreds of businesses across Dane County have installed solar to reduce their operating costs. Typical rooftop solar installations for commercial use can vary from 20kW to 300kW, which is less than the 1MW(ac) where tax credit requirements become more stingent.

Entities can claim tax credits for larger solar arrays through the a) the Investment Tax Credit (which applies to systems under 1 MW) or b) the Production Tax Credit, in which the payment is based on energy generated. Refer to Department of Energy summary for more information or the IRS guidance.

More about transitioning your organization to renewable energy is here.

Projects less than 1 MW(ac)

The IRA will provide 30% funding for solar installations of less than 1 MW(ac) on commercial facilities, with no maximum allowance. The 30% credit also applies to battery storage and interconnection charges.

The incentive applies a 30% tax credit for a for-profit business that files tax returns.

1 MW(ac) or Larger Projects

Solar and wind projects over 1 MW(ac) qualify for a 6% credit that increases up to 30% if prevailing wage and apprenticeship requirements are met.

Entities can claim tax credits for larger solar arrays by a) the Investment Tax Credit (which applies to systems under 1MW) or b) the Production Tax Credit, in which the payment is based on energy generated. Refer to Department of Energy summary for more information or the IRS guidance.

Refer to IRS guidance for more information on both the Production Tax Credit and the Investment Tax Credit for large renewable energy projects.

Credit Stacking

Projects can earn additional tax credits for:

Learn more about how to stack your your credits and deductions.

UPDATE: the credit now ends June 30, 2026.

Builders of new, energy-efficient residential housing may be eligible for the New Energy Efficient Homes Credit (45L).

For single-family homes, builders are eligible for:

For multi-family homes, builder/developers are eligible for:

Contractors and homes must meet requirements in IRC Section 45L before they claim credit. Also, see the Energy Efficient Commercial Buildings deduction (first tab, above) for potential additional project savings if you are constructing a commercial building.

Additional Resources

*Only wind and solar renewable projects <5 MW are eligible to apply for the competitive Low-Income Bonus Program, along with battery storage connected to those projects.

** +10% for projects installed in low-income communities or on Indian land and

+20% for projects that are part of a qualified low-income residential building or qualified low-income economic benefit project

This summary is based on the Investment Tax Credit; larger projects may opt to pursue the Production Tax Credit (where payment is based on system production rather than system cost). Learn more about both options from the US Department of Energy.

Project types eligible for Clean Energy Credits

Project types eligible for Clean Energy Credits

UPDATE: Transferability was not changed in the 2025 budget bill.

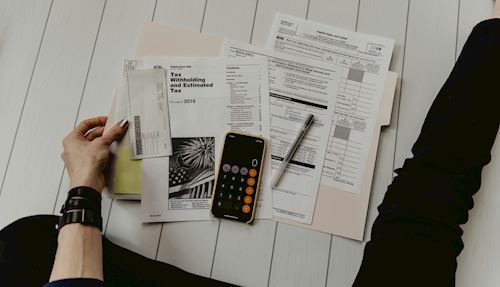

Prior to the Inflation Reduction Act (IRA) entities without a tax liability could not easily benefit from the federal tax credits generated by renewable energy projects. However, the IRA now makes it possible for entities not eligible for Elective Pay to transfer tax credits in lieu of claiming the credits themselves.

Why Consider Transferability?

For-profit entities that do not have sufficient tax liability to claim the entirety of their eligible tax credit can consider selling their tax credits via transferability to a third-party entity in order to regain a portion of these benefits. Generally an entity might be able to except to recoup 80-90% of the original value of the tax credit.

How To Transfer Tax Credits

To initiate transferability, an eligible entity must complete a project and apply for pre-filing registration. Then the entity will find a buyer and agree on sale terms; the buyer will then be provided the registration number and other project information necessary to claim the transferred eligible credit. Finally, the originating entity will complete the transfer election statement with the transferor and include that information with their tax return. Additional details on these steps.

What Credits are Eligible

Portions or all of the following credits are eligible for transfer. However, entities may not transfer a portion of a credit that is related to a bonus credit amount, such as the Domestic Content Bonus.

Contractors may be eligible for additional rebates for electrification projects in addition to tax credits. Learn more about how to qualify through the High-Efficiency Electric Home Rebate Program, which will be administered through Focus on Energy beginning in 2024.

Businesses can receive additional rebates through Focus on Energy. Learn more about which projects are eligible and how to qualify.

Learn more about how to comply with Prevailing Wage & Domestic Content requirements.

Learn more about how to couple IRA tax credits with options for project financing.